The Rise and Fall of Terra Luna: A Cautionary Tale

Written on

Chapter 1: A Tumultuous Week in Cryptocurrency

The recent events in the cryptocurrency world have been nothing short of devastating. The market has seen a staggering loss of a trillion dollars in value—yes, that’s $1,000,000,000,000. Bitcoin struggles to maintain a value around $30,000, and nearly all other cryptocurrencies have followed suit with significant declines. However, the most pronounced collapse belongs to Terra Luna, whose CEO, Do Kwon, now faces intense scrutiny.

Do Kwon's recent tweets indicate a shift from his formerly aggressive tone. He no longer aggressively confronts critics and instead adopts a more subdued approach as he attempts to salvage what remains of his once-mighty crypto empire. Was this merely an elaborate Ponzi scheme?

There are many types of Ponzi schemes, and there will always be individuals who fall prey to such scams. According to the U.S. government, a Ponzi scheme is a fraudulent investment that pays earlier investors with the funds collected from newer investors. Promoters often guarantee high returns with minimal risk, but in many cases, the fraudsters do not actually invest the money. Instead, they use it to pay off previous investors while pocketing some for themselves.

Ultimately, it is up to you to determine whether Terra Luna fits the definition of a Ponzi scheme.

Section 1.1: Understanding TerraUSD and Its Mechanics

Investors in TerraUSD, a stablecoin pegged to the U.S. dollar, could earn returns by staking their coins in the Anchor Protocol, likened to a bank that offered an impressive interest rate of approximately 20%. For every dollar deposited, investors would earn 20 cents. However, as the Anchor Protocol adjusted its rules to implement a variable interest rate, the predictability and stability that investors relied on began to wane.

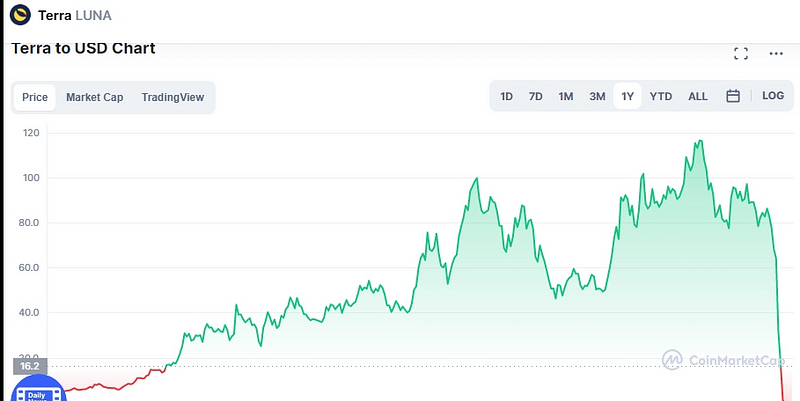

With fewer borrowers in the system, significant holders of TerraUSD started to exchange their assets for other currencies, leading to the collapse of Luna—intended to maintain the peg to the U.S. dollar—resulting in its current near-zero valuation. Just a year ago, Luna was priced at an astonishing $119.18, but today, it has lost nearly all its value.

Section 1.2: The Aftermath and Community Response

Once a top 10 cryptocurrency, Terra Luna now languishes at the 210th position according to CoinMarketCap. Do Kwon has gone relatively silent on social media, only recently resurfacing with a proposed Terra 'Revival' plan.

The first video titled "If You Allocate Capital in a Vacuum, It's Kind of Meaningless" features Do Kwon discussing his views on investment strategies and the current state of the market.

As Kwon continues to express sorrow over the turmoil caused by his project, the community's sentiment has drastically shifted. Many investors are voicing their despair—one individual on Reddit lamented losing over $450,000, fearing impending homelessness and contemplating suicide.

Subsection 1.2.1: The Reality of Do Kwon's Legacy

CoinDesk has revealed Kwon's previous involvement in another failed stablecoin, Basis Cash, under the alias Rick Sanchez. His past actions raise questions about his credibility, especially considering his previous derisive comments towards critics.

The dramatic fall from grace of this once-celebrated crypto figure serves as a stark reminder of the volatility and risks inherent in the cryptocurrency market.

Chapter 2: The Future of the Terra Ecosystem

As discussions continue about a potential fork of the Terra blockchain to revive the ecosystem, the fate of many investors hangs in the balance.

The second video titled "Do Kwon, Terra Found Liable For Fraud" explores the legal ramifications surrounding Kwon and the Terra project, shedding light on the broader implications for the cryptocurrency landscape.

In conclusion, the Terra Luna saga underscores the importance of due diligence and awareness of the risks associated with cryptocurrency investments. Thank you for reading.

Sources:

- WTF Is Luna? WTF Is “Stablecoin”? 5 Things You Need To Know About The Crypto Crash

- How Terra’s UST and LUNA Imploded