The Rise and Fall of WeWork: A Cautionary Tale

Written on

The WeWork Trilogy

The narrative of WeWork can be likened to a Hollywood trilogy, a tale that began with promise but has taken a disheartening turn. It starts with Adam Neumann, who embarks on an ambitious journey to elevate global consciousness—an endeavor that ultimately led to the company's downfall rather than its glory.

In the first act, Neumann’s vision propelled WeWork to a staggering valuation of $47 billion, showcasing the highs of his entrepreneurial adventure. However, the second act reveals the struggles and challenges that followed, culminating in a series of missteps that would reshape the company. Now, as we enter the third act, we confront the harsh reality: the anticipated happy ending has turned into a narrative of decline.

WeBankrupt

In a recent announcement, WeWork raised alarms regarding its sustainability, expressing "substantial doubt" about its future. The company aims to slash lease costs, boost revenue, and seek additional capital through various financial avenues. The statement highlights:

> "Due to the Company’s losses and projected cash needs, combined with increased member churn and current liquidity levels, substantial doubt exists about the Company’s ability to continue as a going concern."

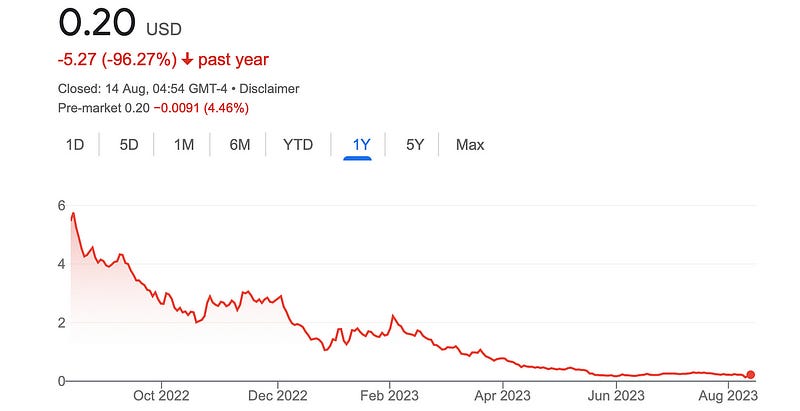

This revelation is hardly shocking. Fitch Ratings had already downgraded WeWork's long-term bonds to a junk status of CCC last year, giving the company a mere six months to stabilize or face potential delisting from the NYSE. The stock has plummeted to $0.20 a share, reflecting a staggering 96% decline over the year, with the market cap now below $300 million despite having raised over $22 billion.

The Signs Were Clear

The warning signs surrounding WeWork's viability have been evident for quite some time. The company has never achieved profitability, and while many startups face similar challenges, this poses significant questions about its business model. WeWork's disastrous IPO attempt left it weakened, and the post-pandemic market shift has diminished demand for office space.

The unexpected departure of CEO Sandeep Mathrani earlier this year, coupled with ongoing lawsuits from landlords, further complicates matters. WeWork continues to grapple with crippling debts and is tied to long-term leases at rates established during more favorable economic conditions. The current economic climate has only exacerbated these issues.

As I noted in WeBroke, the specter of bankruptcy loomed large, and it now appears inevitable. While bankruptcy might offer WeWork a chance to restructure, the company’s extensive rental obligations—nearly 18 million square feet of office space—pose a significant threat to the commercial real estate market, which is already precarious.

The company's ability to adapt is further hampered by a lack of a unique selling proposition in an increasingly competitive landscape. As of June 30, WeWork's liquidity stood at $680 million, overshadowed by its $2.9 billion long-term debt and a negative operating cash flow of $530 million during the first half of 2023. Losses exceeded $2 billion last year, and the year before that, they reached $4.4 billion. These figures cast serious doubt on the company's survival prospects over the coming year.

The Fallout

Should WeWork’s story conclude in failure, the true victor may be Adam Neumann, who, despite the company's collapse, emerged with substantial wealth and an intact reputation. The fallout, however, leaves a multitude of losers in its wake—including employees, shareholders, landlords, vendors, and the myriad of creatives who sought collaborative workspaces.

The Cult of WeWork: The $47 Billion Dollar Lie - This video explores the rise and fall of WeWork, highlighting the mismanagement and the consequences of ambition unchecked by reality.

The Cult of We: The WeWork Story - A detailed examination of WeWork's journey, from its inception to its current state, shedding light on the challenges faced along the way.