The Most Profitable Sector in the S&P 500: Insights and Trends

Written on

Chapter 1: Understanding Profit Margins

Identifying the most lucrative sector within the S&P 500 can be crucial for investors. Profit margins are the key metric to watch. For those actively trading or managing investments, staying informed about market dynamics is essential. While I tend to monitor price movements in real time during market hours, I recognize that not everyone operates this way. Finance is my specialty, so my approach may differ from others. Some investors may check their portfolios daily, weekly, or even monthly, and unfortunately, some only react when market fluctuations catch them off guard.

It's intriguing to see individuals boast about how infrequently they check stock prices, particularly among those invested in individual stocks rather than broad indices. Although I don’t subscribe to the increasingly popular "index and chill" investing mentality, I often find that such attitudes can lead to financial pitfalls. A potential risk currently emerging is the possibility that the recent declines in the Nasdaq could escalate into a more severe market correction. This isn’t without justification; the recent AI hype has inflated expectations, and as that excitement diminishes, it appears we are witnessing a significant market adjustment.

The first video, titled "These SURPRISING Sectors Are Showing Strength," provides insights into the current state of various sectors.

As Goldman Sachs indicates, the hype surrounding AI is waning. The financial implications of nearly $1 trillion in capital expenditures are beginning to materialize, causing soaring valuations in Technology and Communication Services to deflate. The price of a stock is influenced by both qualitative and quantitative elements. The fear of missing out (FOMO) has often driven qualitative valuations, while profits are the foundation of quantitative assessments. For nearly two years, qualitative factors have overshadowed quantitative ones.

A significant number of investors seem to have embraced the AI hype, leading to exorbitant valuations in Big Tech. However, the balance is shifting, as quantitative factors are regaining prominence. This shift marks a tangible example of what is known as "The Gartner Hype Cycle," which illustrates the decline of FOMO from what Gartner refers to as “The Peak of Inflated Expectations.”

The second video, "10 Most Profitable Business Ideas for the Next 30 Years," explores future investment opportunities.

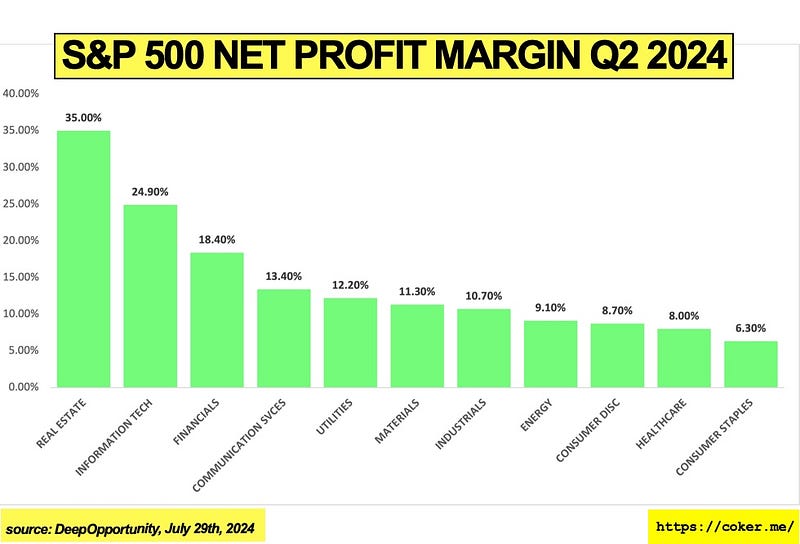

So, what sectors should investors consider as the most profitable moving forward? In layman's terms, where should one look to find financial gains in today's market? Contrary to popular belief, the leading sector in profitability within the S&P 500 is not technology.

According to recent data, the property sector boasts net profit margins of 35%, surpassing the 24.90% margin of Information Technology. Companies in the property sector primarily generate revenue through real estate investment trusts (REITs), although performance can vary widely within this sector. Other common revenue streams include property development, sales, management, and leasing.

It's important to note that market hype is a recurring phenomenon. Over the past decade, technologies like Virtual Reality, Google Glasses, AR, and even companies like Theranos have experienced their own cycles of hype. Each of these innovations has gone through fluctuations in public interest and valuation. The scale of the AI hype has been unprecedented, with speculation driving valuations higher than warranted.

As we look ahead, this week is significant due to an anticipated interest rate decision from the Federal Reserve and earnings reports from major players such as Microsoft, Meta, Apple, and Amazon. As I write this, futures indicate a potentially positive market opening in New York, although premarket conditions can be volatile, leading to rapid reversals once the cash market opens.

For those engaged in the markets, staying vigilant is critical. Regularly checking market conditions is essential, especially if the Nasdaq enters correction territory. This vigilance should go beyond merely observing stock prices; it’s vital to assess where your investments will yield the best returns based on profit and profit margins—the quantitative basis for stock valuation. In the world of investing, numbers truly matter.