Exploring My Bitcoin Journey: From Games to Investments

Written on

Chapter 1: The Start of My Bitcoin Adventure

In 2014, I purchased Bitcoin on Coinbase for the first time, although my initial interaction with the cryptocurrency occurred earlier due to a game. In 2012, Erik Voorhees, a pioneer in the Bitcoin space, launched SatoshiDice—a platform that allowed users to deposit Bitcoin, predict the outcome of a virtual dice roll, and place bets.

This site offered a unique twist on gambling by ensuring transparency in both the odds and the mechanics of the game. SatoshiDice quickly gained immense popularity, at one point accounting for more than 50% of all Bitcoin transactions. In 2013, Voorhees sold the site for $12 million, albeit reluctantly. During this time, he was closely linked to significant developments in the Bitcoin realm, having collaborated with Charlie Shrem at BitInstant and befriended early Bitcoin investor Roger Ver.

His connections even extended to Silicon Valley, where influential figures sought his insight on the future of cryptocurrency.

Despite the rapid rise of Bitcoin, Voorhees felt the weight of regulatory pressures and the demands of being at the forefront of a growing industry. He moved on from SatoshiDice, yet continued to explore other ventures in the cryptocurrency space.

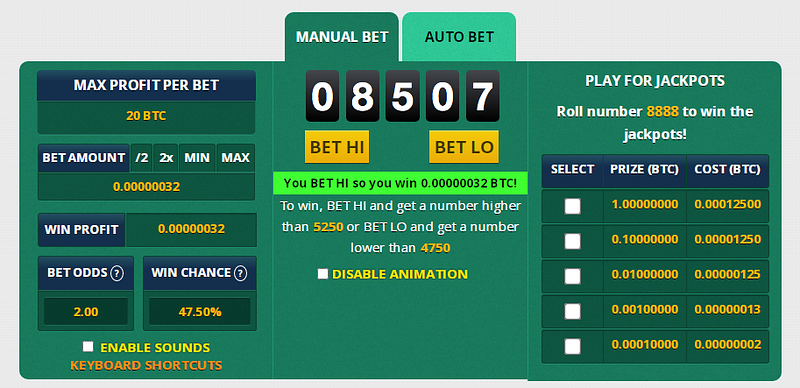

While I never engaged with SatoshiDice directly, I did explore a similar game on freebitco.in, which also functioned as a Bitcoin faucet. This site allowed users to log in hourly to earn small amounts of satoshis—the smallest unit of Bitcoin. The HI/LO game I played required users to wager satoshis, guessing whether a random number would be higher or lower than a predetermined number.

These early gaming experiences were vital in demonstrating Bitcoin's functionality as a currency and its reliability as a network. Between 2012 and 2014, Bitcoin was either actively traded on platforms like Mt. Gox or used for gambling on sites like SatoshiDice. By 2015 and 2016, it became increasingly common to use Bitcoin for purchasing goods and services. During this period, I even acquired a Visa debit card linked to one of my Bitcoin wallets.

I vividly remember transferring the satoshis I earned from HI/LO into my Coinbase wallet, marking it as my inaugural Bitcoin transaction. To this day, I can still play the HI/LO game, though I advise against keeping significant amounts of Bitcoin on such sites. It’s nostalgic to see that it remains operational.

Everyone has their unique path to discovering Bitcoin. Mine began with curious headlines about the notorious Mt. Gox exchange, leading me to a simple game that sparked my interest in the cryptocurrency world.

Want more content like this? Sign up for my newsletter.

Chapter 2: Understanding Bitcoin's Market Dynamics

How Much Bitcoin Should You Own?

When considering an investment in Bitcoin, it’s essential to take various factors into account.

Bitcoin Price Trends

Recently, Bitcoin seemed poised to reclaim the $50,000 mark, but both traditional and cryptocurrency markets underwent corrections. At present, Bitcoin hovers around $40,000—a significant level that many investors are closely monitoring.

The $42,000 price point is particularly noteworthy, as it appears to be a critical threshold for Bitcoin's price movements. I've observed this range for nearly a year, and it serves as a major support and resistance level.

Despite trading close to where it began the year, Bitcoin remains up from its January and February lows, and it has shown resilience since the onset of the Russian invasion of Ukraine, maintaining a steady presence above $30,000.

Long-term Support Levels

Bitcoin has now spent 14 consecutive months trading above the $30,000 mark, which has established itself as a long-term support level. While there were fluctuations around the mid-$30,000s earlier this year, the $30k level has remained robust since last summer.

Psychological Resistance

It's worth noting that Bitcoin has only briefly traded above $50,000 or $60,000, totaling around two months. The $50,000 mark is not just a numerical barrier; it carries significant psychological weight, as the volume of transactions at or above this level has been limited.

I maintain a bullish outlook, projecting that Bitcoin will eventually surpass its previous all-time high of $70,000 in 2022. It's merely a question of timing before it retakes the $50,000 threshold.

Conclusion

The recent Bitcoin 2022 conference in Miami highlighted the progress made within the cryptocurrency space. The event introduced the "Miami" or "Bitcoin Bull," symbolizing the resilience and growth of Bitcoin. Every initiative that promotes Bitcoin increases awareness of the evolving financial landscape.

As I keep an eye on the upcoming months, I'm optimistic about Bitcoin's future, having transitioned from taking risks with HI/LO games to safeguarding my investments through self-custody. Although we may face turbulent times ahead due to inflation and unstable traditional markets, it's crucial to maintain perspective, remain humble, and continue accumulating satoshis.

Thank you for reading! Please note that I am not a financial advisor, and this content should not be construed as financial advice. All views expressed are my own. For more insights, consider subscribing to my weekly newsletter.